As the world increasingly embraces digital currencies, the importance of secure and efficient tools to manage these assets has never been greater. Enter the trustwallet—a cornerstone of the cryptocurrency ecosystem. Whether you’re a seasoned trader or a curious beginner, understanding crypto wallets is essential for navigating the decentralized financial landscape.

What is a Crypto Wallet?

A crypto wallet is a digital tool that allows users to store and manage their cryptocurrency assets securely. Unlike traditional wallets that hold physical money, crypto wallets store the private and public keys necessary to access and transfer cryptocurrencies. These wallets don’t hold the currencies themselves but interact with blockchain networks to facilitate transactions.

Types of Crypto Wallets

Crypto wallets can be broadly categorized into two types: hot wallets and cold wallets. Each comes with its unique features, benefits, and trade-offs.

1. Hot Wallets

Hot wallets are connected to the internet, making them accessible and convenient for frequent transactions. Examples include:

- Web Wallets: Accessible via web browsers, often provided by exchanges like Coinbase or Binance.

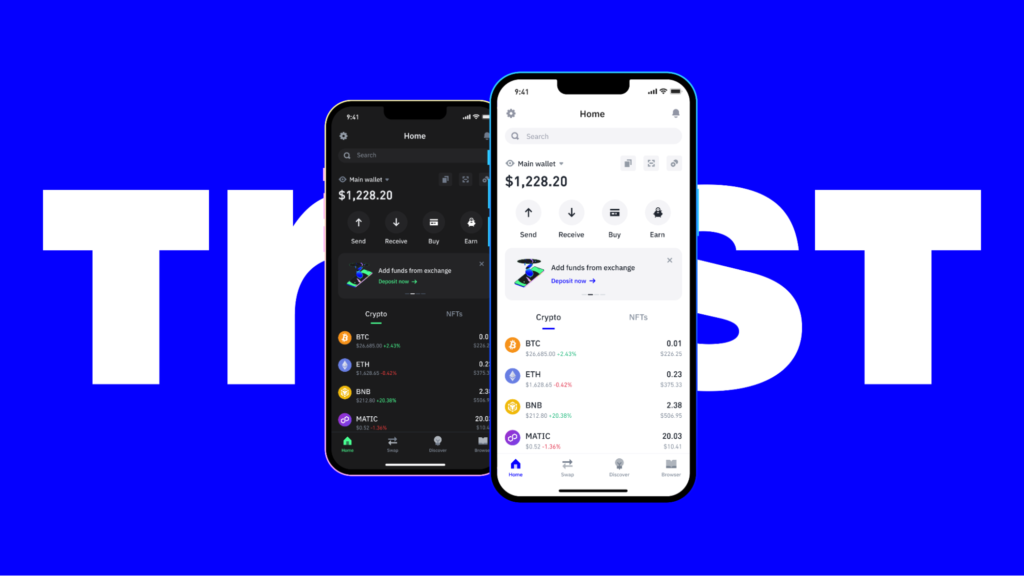

- Mobile Wallets: Smartphone applications designed for on-the-go transactions, such as Trust Wallet or MetaMask.

- Desktop Wallets: Software installed on a computer, offering more control and security than web wallets.

While hot wallets are user-friendly, their internet connectivity makes them more susceptible to hacking and phishing attacks.

2. Cold Wallets

Cold wallets are offline storage solutions, offering enhanced security for long-term cryptocurrency storage. Examples include:

- Hardware Wallets: Physical devices like Ledger Nano X and Trezor that store private keys offline.

- Paper Wallets: Physical documents containing private and public keys, generated using online tools.

Cold wallets are ideal for users who prioritize security over convenience, as they are immune to online threats but require careful handling to prevent loss or damage.

How Does a Crypto Wallet Work?

At its core, a crypto wallet functions by managing private and public keys:

- Public Key: Acts like an account number, allowing others to send cryptocurrency to your wallet.

- Private Key: A secure digital code that grants access to your assets and enables transactions.

When you initiate a transaction, your wallet uses your private key to sign it, ensuring authenticity and integrity. The transaction is then broadcast to the blockchain network for verification and recording.

Choosing the Right Wallet

Selecting the right wallet depends on your needs, trading habits, and security preferences. Consider the following factors:

- Purpose: For daily transactions, hot wallets are ideal. For long-term storage, cold wallets are recommended.

- Security: Look for wallets with robust encryption, two-factor authentication, and backup options.

- Ease of Use: Beginners might prefer user-friendly interfaces, while advanced users may prioritize customizable features.

Security Best Practices

To protect your assets, follow these essential security tips:

- Keep Your Private Keys Secure: Never share your private keys with anyone.

- Enable Two-Factor Authentication (2FA): Adds an extra layer of security.

- Use a Strong Password: Avoid using easily guessable passwords.

- Backup Your Wallet: Store backups in multiple secure locations.

- Be Cautious of Phishing Scams: Verify the authenticity of websites and emails.

Conclusion

Crypto wallets are indispensable tools for anyone participating in the cryptocurrency space. By understanding their types, functionalities, and security measures, users can confidently manage their digital assets.